NIRP Arrives: US Treasuries Trade With Negative Yield

- NIRP Arrives: US Treasuries Trade With Negative Yield

by Tyler Durden, https://www.zerohedge.com/

With the Fed’s cutting rates three days ahead of the regular Wednesday FOMC announcement by 100bps to 0%-25bps, while also announcing a fresh $700BN QE as well as enhanced FX swaps, panic is in the air as reflected in the S&P futures which have been locked limit down since the open, and with equity traders frozen out and unable to do anything all the attention has shifted to rates where all hell is breaking loose.

–

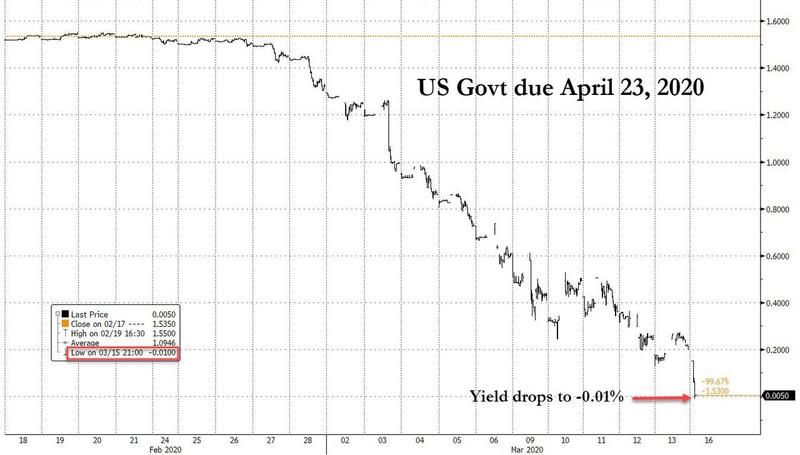

As BMO’s Ian Lyngen wrote in his Fed post-mortem “it is not inconceivable that we see negative Treasury yields in the front end when Asia comes back on line”, and that’s precisely what has happened, when yields on several Treasury bonds expiring in the next three months are getting quoted at slightly negative levels during Asia hours following the Fed’s 100bps rate cut.

–

One such example is the US govt bond maturing April 23, or in five weeks, which briefly dipped below zero, touching -0.01% after trading at 1.50% just two weeks ago.

–

read more.

end