Which Banks Were Behind The “Repocalypse” Funding Squeeze?

- Which Banks Were Behind The “Repocalypse” Funding Squeeze?

by Tyler Durden, https://www.zerohedge.com/

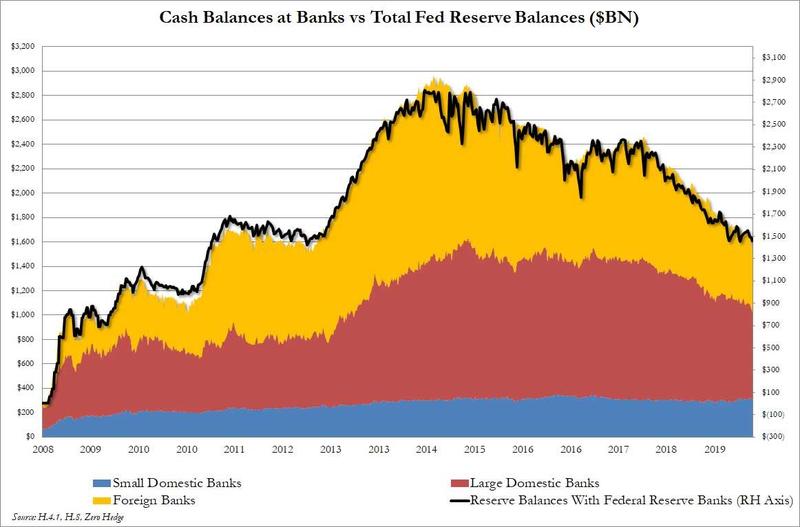

Last weekend, as the overnight funding crisis was peaking, we showed the distribution of $1.4 trillion in Fed reserves, also known simply as “cash”, across the banks that make up the US financial system.

–

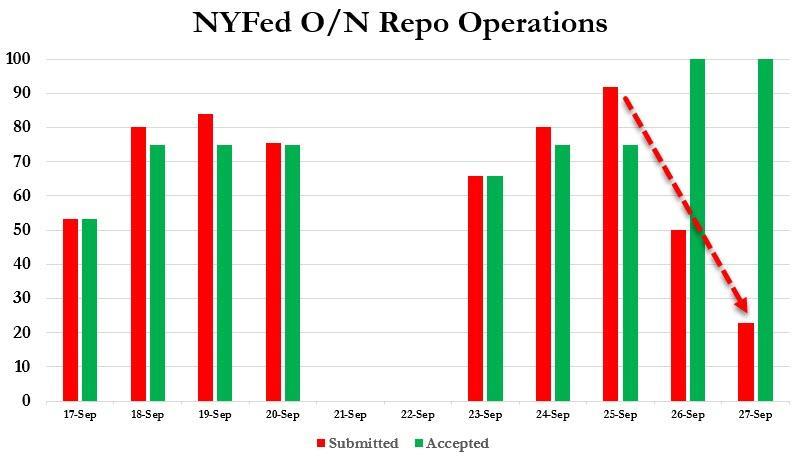

One week later, with the dollar “plumbing” shock seemingly unclogged as we approach quarter end, following $162BN in various term and overnight repo operations…

–

… which helped push the overnight G/C repo rate back down to 2.00%, questions are still swirling over events in the past two weeks that briefly sent the repo rate soaring as high as 10% as one or more banks found themselves on the verge of a funding crisis.- The first question is what happened to prompt the sudden liquidity panic: while we know of the immediate events that led to a sharp drop in bank cash (reserve) levels such as the accelerated rebuild of the Treasury’s General (cash) Account at the Fed, the mid-month tax remittance to the Treasury, and the bulk settlement of Treasury bills, the fact that repo strains remained well into the next week and forced the Fed to drastically expand its repo operations, indicates that something far more serious was afoot than one time cash drains.

- The second, and perhaps even more important question, is which were the banks the catalyzed the initial funding shortfall, which then spread rapidly across the entire US dollar funding market. Here, as a reminder, even the NY Fed appeared clueless, with John Williams noting last Friday that the York Fed was examining “why banks with excess cash failed to lend to the overnight money market, following a week that revealed cracks in the US’s financial plumbing.”

Setting aside what we don’t know – i.e., the immediate causes for the recent events and which specific banks were the catalysts – if we had to jot down what we do know, it is that it is now widely accepted that the level of “excess” reserves, at $1.4 trillion, is far too low for the financial system. As a result, first Goldman…

–

read more.

end